We believe that the following trends provide market participants the opportunity to maximize profits and minimize losses. The bottom line is that inertia causes prices to move higher when buyers are more aggressive than sellers, and vice versa when selling dominates buying. Prices often rise to levels that may seem irrational, unreasonable, and illogical compared to a market’s fundamentals.

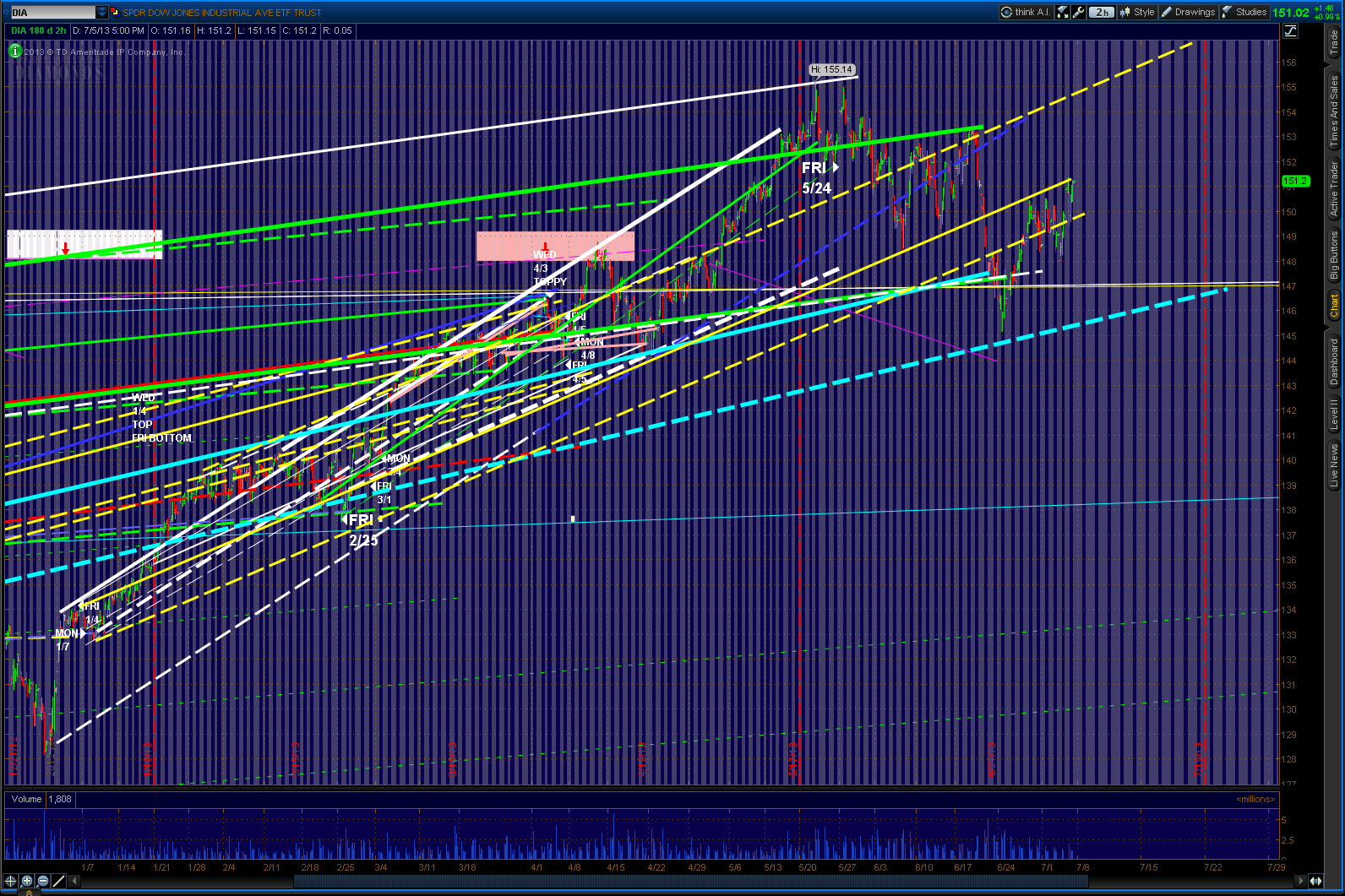

It states a body at rest tends to stay at rest, and a body in motion tends to stay in motion unless acted on by a net external force. Newton’s first law of motion is all about inertia. 24, we were long the DIA ETF in our portfolio, but we went from long to short to long last week during a choppy period for the index. The SPDR Dow Jones Industrial Average ETF Trust ( NYSEARCA: DIA) is the product that reflects changes in one of the most closely watched stock market indices. In 2020, Salesforce ( CRM), Amgen ( AMGN), and Honeywell ( HON) replaced Exxon Mobil ( XOM), Pfizer ( PFE), and Raytheon Technologies ( RTX). In 2021, the Dow thirty looks far different as it includes: In 1928, just one year before the stock market crash that ushered in the Great Depression, the Dow thirty was expanded to include the following companies: In 1916, the DJIA included twenty stocks. The Dow Jones Industrial Average is a price-weighted measurement stock market index of 30 prominent companies listed on stock exchanges in the United States.

0 kommentar(er)

0 kommentar(er)